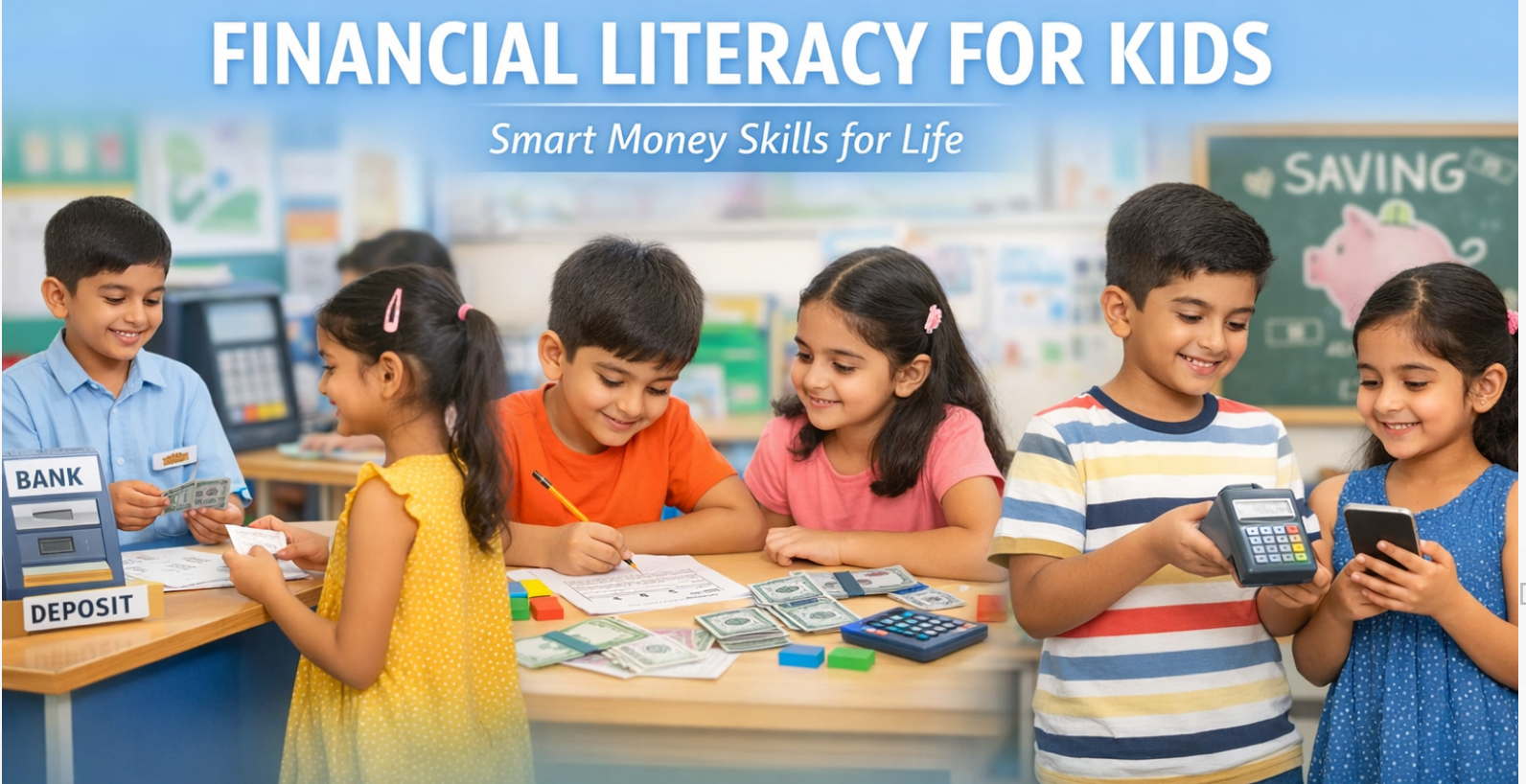

Financial Literacy Program for Kids in India

With Dedicated Financial Literacy Books & Practical School Kits

In today’s fast-evolving digital economy, children must learn how money works in real life, not just in theory. A complete Financial Literacy Program for Kids combines structured books with hands-on practical kits, ensuring children understand money concepts deeply and confidently.

To meet this need, Junior Engineers has developed a comprehensive Financial Literacy ecosystem for schools, consisting of Financial Literacy Books and Financial Literacy Practical Kits designed specifically for Indian classrooms.

Junior Engineers Financial Literacy Books for Schools

The Junior Engineers Financial Literacy Books are age-appropriate, visually engaging, and aligned with Indian education standards. These books go beyond definitions and focus on real-life money skills children can apply daily.

Key Features of the Books

- Age-wise structured curriculum (Primary to Middle School)

- Indian context with ₹ currency examples

- Simple language with engaging illustrations

- Concept-based explanations with real-life scenarios

- Worksheets, activities, and review exercises

- NEP 2020–aligned life-skills focus

What the Books Cover

- What is money and why we use it

- Needs vs wants

- Saving habits and goal setting

- Budgeting pocket money

- Banking basics (account, deposit, withdrawal)

- ATM, debit cards, and digital payments

- Online safety and smart money choices

These books act as a student handbook that builds financial awareness step by step.

Financial Literacy Practical Kits for Schools (Hands-On Learning)

To transform learning from reading to real understanding, Junior Engineers offers Financial Literacy Practical Kits a powerful tool for experiential learning in classrooms.

What Is a Financial Literacy Practical Kit?

A Financial Literacy Practical Kit is a role-play–based learning kit that allows students to experience real-world financial situations through guided activities.

Kit Components (Indicative)

- Bank role-play board & counters

- Deposit and withdrawal slips

- ATM & debit card mock-ups

- Passbook and account forms

- Loan, repayment & locker cards

- UPI / digital payment activity cards

- Shopkeeper-customer role-play materials

- Indian currency replicas (educational use)

Activities Conducted Using the Practical Kits

- Opening a bank account (role play)

- Depositing and withdrawing money

- Using ATM and debit cards

- Planning a simple budget

- Taking and repaying a loan

- Understanding savings and interest

- Safe digital money transactions

These activities make learning fun, memorable, and practical.

Why Books + Practical Kits Work Best

Combining Financial Literacy Books with Practical Kits ensures:

✔ Concept clarity through reading

✔ Real-world understanding through action

✔ Improved retention and engagement

✔ Confidence in handling money situations

✔ Active participation instead of rote learning

This blended approach is ideal for school classrooms, activity periods, and workshops.

Ideal for Schools, Trusts & Institutions

The Junior Engineers Financial Literacy Program with Books & Kits is perfect for:

- CBSE & ICSE schools

- Private & international schools

- After-school programs

- Educational trusts & NGOs

- Activity-based learning centers

- Home-Schooling

It can be implemented as:

- A standalone financial literacy subject

- A life-skills module

- An activity-based enrichment program

Alignment with NEP 2020

The program strongly supports NEP 2020, focusing on:

- Practical life skills

- Experiential learning

- Real-world application

- Holistic child development

Books build knowledge.

Practical kits build confidence.

Together, they create financially aware, responsible, and future-ready students.

Visit: Junior Engineers

Call: 9899732008

Frequently Asked Questions

Q. What is the best age to start financial literacy for kids?

Children can start learning basic money concepts as early as 6 years of age.

Q. Is financial literacy part of the school curriculum?

Financial literacy aligns with NEP 2020 life-skills education and can be added as a school program.

Q. Does this program include digital payment education?

Yes, children learn UPI, online payments, and digital safety in an age-appropriate manner.

Financial literacy for kids in India, financial education for children, money management for kids, kids financial literacy program, financial literacy curriculum for schools, budgeting lessons for kids, banking education for children, digital money education for kids, life skills program for students, financial literacy classes for kids.

Leave a Comment