The Missing Classroom Skill: Why a Financial Literacy Program for Kids is Crucial for Their Future (and Why India is Leading the Way)

Let me be blunt. Over the last two decades of writing about education, parenting, and social trends, I’ve noticed a glaring gap in what we teach our children. We obsess over math scores, worry about reading levels, and ferry them to endless coding camps and soccer practices.

But we are fundamentally failing to prepare them for one of the most defining aspects of their adult lives: managing money.

I’ve seen brilliantly smart young adults ivy-league educated, even drowning in credit card debt at 23 because they didn’t understand compound interest. I’ve seen teenagers paralyzed by anxiety about student loans because nobody ever sat them down and explained how debt actually works.

In today’s complex economic landscape, a Financial Literacy Program for kids isn’t a “nice-to-have” extracurricular. It’s a survival skill the bedrock of future stability. If you’re searching for “how to teach kids about money,” “best financial programs for children,” “financial education for youth,” or “money management skills for kids,” you’re in the right place.

Below, I explain why this education is urgent, how Junior Engineers is pioneering it in India, and how to get your child started.

The Invisible Money Crisis: Why This Is Necessary NOW

Yes, kids have always needed to learn about money but the landscape has changed.

When I was a kid, money was tangible. You earned a note, put it in a piggy bank, and watched it leave your hand at the store. The transaction had weight.

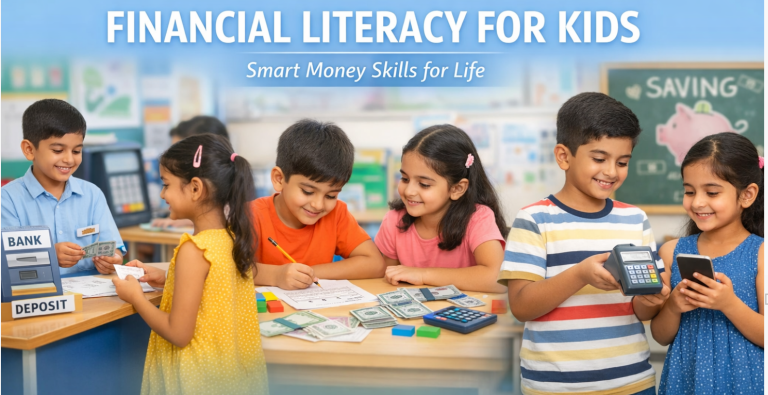

Today, money is mostly invisible. Kids see parents tap a phone at checkout, scan a QR, or “Buy Now” online. The connection between labor, earning, and spending has been severed by friction-free digital payments. That’s why “financial planning for kids”, “Financial Literacy Program for Kids in India” and “children’s budgeting workshops” are now essential conversations.

Without intentional intervention, children can mistake money for an infinite resource that flows from a magic card or smartphone app.

A robust program bridges this gap turning abstract economics into concrete, age-appropriate, even fun learning. We’re not teaching checkbook balancing; we’re preparing them for the gig economy, digital payments, EMIs, investing basics, and safe online consumer behavior true youth financial education.

Enter Junior Engineers: A Blueprint for Financial Fluency

Junior Engineers widely respected for STEM, Robotics, and Coding asked a crucial question:

What good is engineering the next billion-dollar app if you can’t manage the money it generates?

Their answer is a specialized financial literacy course for school students that stands out by being practical, playful, and deeply real-world.

A Game-Changer for India: Pioneering Financial Literacy with a Dedicated Book

Here’s what deserves applause. Beyond an interactive program, Junior Engineers includes a tangible, comprehensive Financial Literacy Book for kids as a core component raising the bar for kids’ money education in India.

Why does this matter? Because while gamified classes are fantastic, a physical book creates continuity at home. Children can revisit lessons with parents, reinforce vocabulary, and build durable habits. It’s not a pamphlet; it’s a structured learning tool that cements classroom learning in daily life setting a new standard for financial education in India and empowering lasting money skills for children.

What Junior Engineers Provides (Program Highlights)

Junior Engineers builds what I call financial muscle memory habits kids can actually use.

1) Gamified Learning

Simulated economies, earn-and-spend challenges, resource management, and “upgrade choices” make learning about money for kids engaging and sticky.

2) Entrepreneurial Mindset

Kids explore revenue vs. profit, cost, pricing, and simple business models developing entrepreneurial skills for kids and becoming wiser consumers.

3) Debt & Credit, Demystified

Age-right lessons on APR, interest, EMIs, credit cards, and responsible borrowing core credit education for youth.

4) Saving & Investing Basics

Savings vs. investments, risk vs. reward, mutual funds 101, and the magic of compounding true early investment education without hype.

5) Real-Life Role Play

Budgeting groceries, bill payments, pocket-money planning, goal-based savings, and a mini-market so concepts stick beyond the classroom.

Long-Term Benefits for Your Child

- Confidence & Lower Anxiety: Understanding money reduces future stress. Kids feel in control.

- Delayed Gratification: Patience and goal-setting in a swipe-and-scroll world.

- Better Decisions: Opportunity cost, trade-offs, and critical thinking become second nature.

- Early Wealth Habits: Learning compounding at 12 beats discovering it at 32.

- Entrepreneurial Spark: Initiative, creativity, problem-solving, and ownership thinking.

Flexible Learning: Year-Long, Holiday, and Online Programs

Junior Engineers understands modern families.

So their Financial Literacy Program for Kids comes in multiple formats:

1. Year-Long Program

A structured journey covering:

- 40+ lessons

- Worksheets

- Case studies

- Practical projects

- Assessments and certifications

A deep foundation for long-term financial mastery.

2. Holiday Program (Summer & Winter Camps)

Intensive, fun, short-term learning.

Perfect for:

- School breaks

- Skill-building vacations

- Hands-on financial experiences

Kids love it. Parents love it even more.

3. Online Program

For families who prefer virtual learning:

- Live classes on Financial literacy Program for Kids

- Digital worksheets or Physical Financial Literacy Book

- Interactive tools

- Case studies

- Budgeting projects

Your child learns money management from home anywhere in India.

Twenty years from now, your child won’t recall their 5th-grade history marks. But they will navigate salaries, taxes, EMIs, investments, digital payments, and maybe their own startup.

Traditional schooling isn’t moving fast enough. A Financial Literacy Program for Kids like Junior Engineers’ is one of the most practical gifts a parent can give: security, confidence, independence, and real-world wisdom. With a pioneering curriculum and a dedicated book to reinforce learning at home, India truly is leading the way.

Don’t let money remain a mystery. Pull back the curtain, teach them how the system works, and watch them become confident, capable young adults.

Search “Junior Engineers Financial Literacy” today and give your child the gift of financial foresight.

Ready to raise a money-smart child?

Enroll in Junior Engineers’ Year-Long, Holiday, or Online Financial Literacy Program.

Call: 9899732008 | Email: tarun@imaxacademy.com

Visit Us; Junior Engineers Financial Literacy Program for Kids

Q1. What age is right to start financial literacy?

Ages 6–14 is ideal. Concepts are taught age-appropriately from needs vs. wants and pocket money to interest, EMIs, and basic investing.

Q2. Is an online program as effective as offline?

Yes if it’s interactive. Junior Engineers uses live teaching, role-play, digital worksheets, and projects to keep it hands-on.

Q3. Why include a physical book?

The book anchors learning at home, lets parents participate, and helps kids retain concepts long after class.

Q4. Will my child learn about investing?

Basics only risk vs. reward, compounding, and mutual funds. No trading; just foundations for smart choices later.

Q5. How quickly will I see changes?

Parents usually notice smarter spending, savings goals, and better decision-making within a few weeks.

Leave a Comment